A cheaper alternative and changing lifestyle

Khong believes co-living is gaining traction as it is a cheaper alternative to renting an entire apartment or house, which requires hefty deposits.

“Renting an entire apartment will cost at least 2+1 months of cash deposit payable upfront compared with renting a co-living space, where no large upfront deposit is required,” he says.

Eddy concurs, noting that the lack of housing affordability will also drive demand for co-living.

JLL compared the cost of renting a co-living room in Singapore with renting a room in the same apartment under a traditional one- to two-year lease. At first glance, the headline rent for the co-living room was 27% more than under the traditional rent model.

“However, after accounting for all expenses incurred by a tenant throughout a lease and considering things like the amortised lost value of furniture, exit cleaning costs and general maintenance, the real cost premium of living in a co-living (like-for-like) unit is around 5% in this scenario,” says JLL.

Without lease break costs or applicable agent fees, as well as the time saved on going through a traditional rental process, co-living can be cheaper than a traditional landlord-tenant model, notes JLL.

“Managing the process of moving in, moving out and the ongoing logistics of living under a tenant-landlord model that is intermediated by a property manager and an agent is highly inefficient and often frustrating. Dealing with a single company on all related issues, as well as peace of mind regarding relocation or moving out, creates huge upside for the tenant base,” says JLL.

According to Eddy, Cove co-living in Singapore advertises that its accommodation cost is lower than renting a studio apartment, owing to not having to furnish the unit or pay for utilities, housekeeping and WiFi, which are typically included in a co-living package.

“It is the housing version of a ‘plug-and-play’ concept, where you only need to move into the premises with your suitcase and everything else is already included in the package. There is also flexibility in terms of tenure as shorter tenancy periods are available for co-living. This would suit those who like to keep their options open while they contemplate and experience different lifestyle and living choices,” says Eddy.

Co-living also provides a community platform for more social interaction and convenience for the tenants.

“These collaborative spaces tend to promote better utilisation of personal assets while reducing inefficiencies wherever applicable. It may look to be more expensive than traditional leasing options but with co-living offering fitted and furnished options, it reduces additional costs and time spent in getting the space ready for use,” says Khong.

Eddy says while co-living started off as an affordable housing option, it has evolved into a lifestyle choice for those who enjoy being part of a larger community.

JLL notes that another factor is the changing lifestyle of the young, with millennials valuing experiences over ownership of things, and that service-based living is on the rise, from student housing to family rentals.

“Hotel operators and developers are picking up on this trend, and focusing more on ‘branded living’, as demand for the service-based aspect of residential takes priority. Even senior care homes are becoming more about the extras and lifestyle, contributing to an evolving set of living categories across the life spectrum,” says JLL.

Co-living in Malaysia

Co-living is still in its infancy in Malaysia but Eddy believes the concept will gain traction in tandem with the growing appeal of the sharing economy.

There are already a few co-living businesses in the local market. An early entrant was The Hatchery Place in USJ, Subang Jaya, founded by Elaine Wong and Kevin Yeoh in 2016 after the couple quit their corporate jobs the year before.

Finding working at home too distracting and not wanting to travel out of Subang Jaya, Elaine and Yeoh set up what they called a “creative house”, located just 15 minutes from their own home. Elaine took a room to use as her art studio, and Yeoh took another for his craft room, while the space downstairs was used for co-working.

“We converted the remaining two rooms into co-living rooms so we could have like-minded creative peers to not only work together but also share living spaces with us, as part of our intention to redesign our social circles,” says Elaine.

She believes that being intimately integrated in the community they have created makes The Hatchery Place different from the other operators in the market. The couple create activities for guests based on their own interests, including art and craft events, food and drink tasting, poetry nights, drum circles, and painting and woodworking workshops.

“Those who have stayed with us have become our lifelong friends, and the locals who co-worked with us have grown to become important allies in our creative endeavours. Many travellers return for month-long stays to focus on their projects,” says Elaine.

The Hatchery Place has housed more foreigners than locals, mainly digital nomads aged 23 to 45. The minimum stay is one week and rates start from RM385 a week.

“The average stay is three to four weeks. We have also had a number of 90-day stays and beyond,” says Elaine.

Operating on a larger scale is JL Coliving (JLCL), which was founded by Jessica Lee in 2018 and has two co-living premises in USJ 21 and The Mines in Seri Kembangan.

Lee came up with the idea for JLCL to address the issues of a lack of communication between housemates, safety and increasing isolation in modern society.

JLCL has 50 rooms in total with rates starting from RM650 a month. It offers a laundry room, meeting room, reading area, hot desks and a space for movies.

“The response has been good. We get a lot of positive feedback on our location and cleanliness. We have also received constructive feedback from our tenants such as having a kitchen. We currently provide only coffee, tea and snacks. Some of our tenants have also requested specific hotel essentials such as disposable dental care pack and shower cap, which we are looking to provide in the near future,” says Lee.

JLCL’s tenants are mostly between the ages of 17 and 30, and comprise mainly students and working adults.

“Sometimes we get digital nomads from other countries such as the UK, Russia, China and overseas tenants. Most are individual tenants as opposed to corporate tenants,” says Lee.

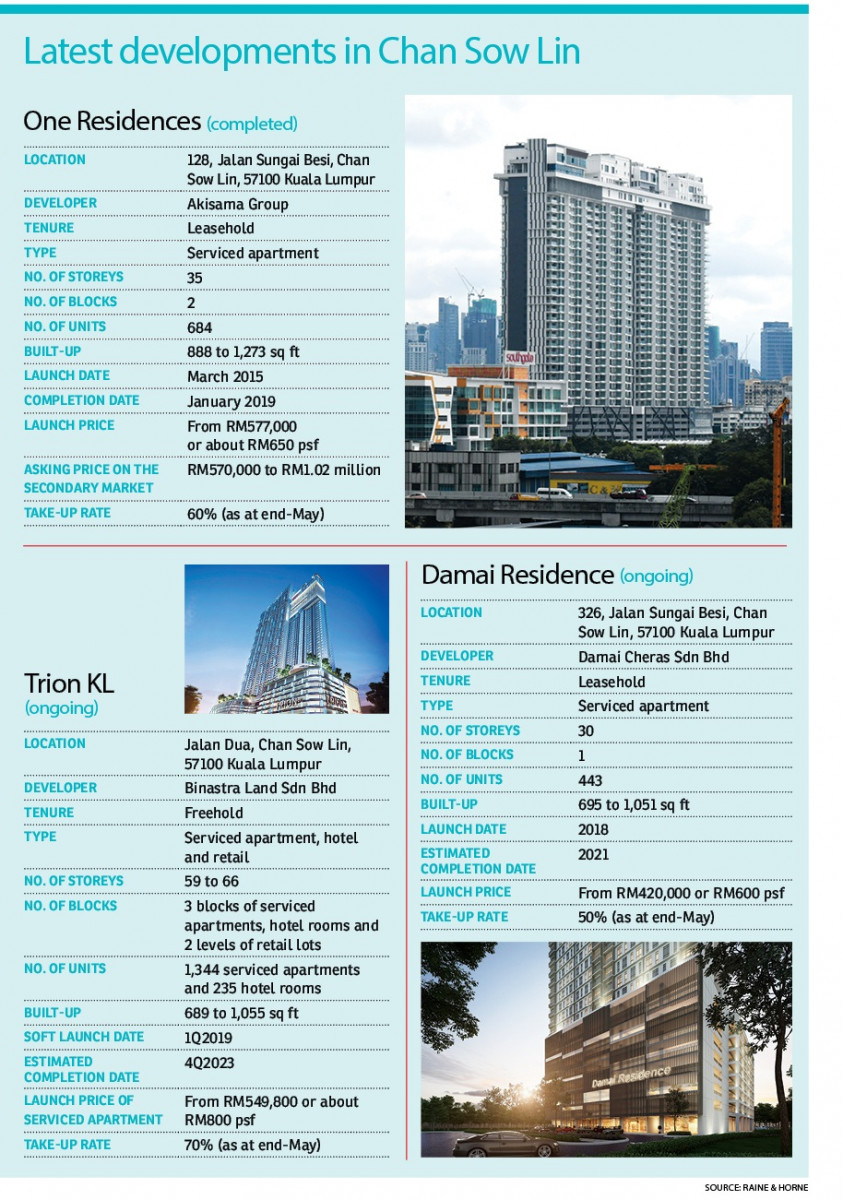

Property developers have also got in on the act. Tan & Tan Developments Bhd opened Co-Living @ Damai Residence in Ampang in January 2019 and UOA Group started Komune Living in Bangsar South in October 2019.

Damai Residence was initially designed as apartments to be sold but once the idea for co-living was conceived, the developer stopped selling the units. The fitting out of the interiors cost about RM4 million.

There are 174 private fully furnished rooms with single or double occupancy, and a choice of en-suite or shared bathrooms. Rent starts from RM1,000 a month, which includes all utilities, community events and use of all facilities.

Among the facilities are a shared kitchen and dining area, an entertainment zone, a gym and a communal lounge, while the co-working section offers a meeting room, a discussion area, an open office space and a printing and photocopy room.

According to Tan & Tan Developments CEO Tan Yee Seng, the concept has been very well accepted by both locals and foreigners.

Photo by Tan & Tan Developments

“We have received a lot of positive feedback from our tenants. They especially emphasise that this healthy community formed within the building is just like their family. The advantage of staying in Co-Living @ Damai Residence is that we have an on-site community team to provide assistance to the tenants. The team will also organise events and activities such as movie nights, cultural food gatherings and outdoor activities,” says Tan.

The average tenancy period is six months and the tenants are mainly between the ages of 24 and 35.

“We have tenants as young as 18 all the way to 63 years old. They are mostly professionals, interns and work-from-home (WFH) individuals. Currently, locals make up 30% of the tenants and foreigners, 70%. Since the inception of our co-living project, we have received tenants from 34 nations,” says Tan.

Komune Living, which opened its doors late last year, is managed by UOA Hospitality, UOA Group’s hospitality arm. It has 648 units of private studios and apartment-style rooms, with rates starting from RM1,900 a month.

Komune Living general manager Mark Chen says it has an average occupancy rate of over 70%.

“Guests appreciate the all-in, hassle-free living solution that we offer. Our price is inclusive of utilities, WiFi, daily breakfast and housekeeping twice a week. Our tenancy contract is more flexible compared with others that require a minimum stay of six to 12 months. The short duration commitment greatly influences guests’ decision to stay with us.

“Our communal facilities, such as the community lounge and kitchen and the 24/7 game base, provide our guests with a space to hang out instead of staying in their rooms. This makes Komune Living feel more like home. The familiarity and interaction are pull factors for them,” says Chen.

The average length of short stay was 2.5 to three nights during the promotional period of October to December 2019, while the average length of long stay is three months to a year.

“Our current guests’ demographics range from 25 to 45 years old and comprise corporate clients, online business owners, postgraduates and undergraduates, freelancers and working IT professionals.

“Our business is 60% short term and 40% extended stay. From October to December 2019, locals comprised 80% of our guests and foreigners, 20%. Foreigners, mainly from the Philippines, Indonesia, South Korea and Japan, outnumber locals in terms of long-stay guests,” says Chen.

He adds that the co-living concept attracts more individual guests (about a quarter are corporate guests) and most learnt about Komune Living via its online brand awareness campaign.

Photo by The Hatchery Place

What the future holds

The Hatchery Place’s Elaine believes the trend of co-living is catching on in Malaysia, which is a good thing.

“The Hatchery Place reflects us, so it has our personal touch. The more others start to create their own version of co-living, the more choices would be available to tailor to each person’s lifestyle needs. Co-living has become a movement to tackle the global issue of a growing sense of isolation and loneliness in our digitally connected world,” says Elaine.

JLCL’s Lee encountered scepticism from friends and others when explaining the concept of co-living.

“However, I certainly foresee more co-living spaces opening. There is a market for co-living; you just need to define your target market. That said, the cost of opening a co-living space will always be a factor. Expansion is the biggest challenge for me. This business needs a big investment to start. Nonetheless, I’m very positive and passionate about co-living,” she says.

Tan & Tan Developments’ Tan notes that flexibility, convenience and affordability are very important to people these days and there is opportunity for more co-living spaces as the trend of renting catches on.

Komune Living’s Chen says, “It’s a new way of living with a better quality of life, where the cost is reduced, allowing you a sense of ease.

“With the increasingly solitary lifestyle today, co-living’s appeal and acceptance will continue to grow and create new demand. This will lead to more co-living spaces opening in the future.”

Meanwhile, Nawawi Tie Leung’s Eddy feels that co-living can be a solution to the number of unsold properties in Malaysia as they can be repurposed into co-living spaces.

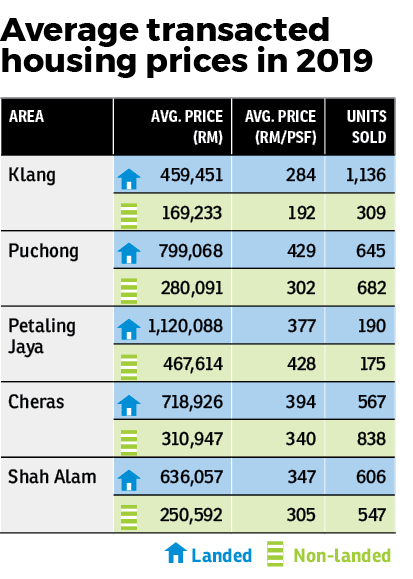

Savills Malaysia’s Khong says housing in Malaysia has yet to reach the extreme situation in major cities such as Hong Kong and Shanghai.

“Malaysia is still slightly behind in terms of actual co-living as it is still affordable to rent an apartment. Co-living spaces will flourish when living costs are high in KL and people find it hard to afford a sizeable place.

“However, there is still a niche demand for co-living. It attracts a certain category of people who are looking for a slightly luxurious fitted-out space to stay. It offers pure convenience, hassle-free, low-cost entry in terms of deposit and also a taste of communal living.”

Photo by JL Coliving

Co-living in the Covid-19 era

The Covid-19 pandemic has impacted economies worldwide and the co-living market segment has not been spared.

“The co-living sector operates in the hospitality space. The pandemic has meant upgraded levels of hygiene across the board — which is a good thing. Operators will therefore have to focus on cleanliness and hygiene in shared spaces and common areas,” says Khong.

Tan says Co-Living @ Damai Residence’s occupancy rate has dropped since the implementation of the Movement Control Order (MCO), mainly because some of its foreign tenants were recalled to their home countries.

“We started to gear up our marketing activities when the Conditional MCO was implemented. Currently, we are focusing mainly on digital marketing. Other marketing plans in the pipeline include event collaboration with different partners once the situation improves and holding events is permitted,” says Tan.

As for The Hatchery Place, Elaine says it has stopped taking bookings as it is now focused on serving the remaining co-living residents, who are staying put in the country because of closed borders.

She believes people need connection and interaction and it is possible that the restriction in movement may result in a desire to connect even more after the crisis.

“We are taking the current downtime to look into how to be more innovative, sustainable and responsible and create more opportunities when this ends. We are constantly reaching out to other co-living operators around the world to stay up to date with current trends, challenges and solutions,” says Elaine.

Nawawi Tie Leung’s Eddy believes the pandemic has not changed the factors that drive co-living demand such as shared accommodation and cost, community-centric living and lease flexibility.

“People still need a place to stay and we are basically social creatures, so the desire to be part of a community remains intact, albeit the interactions may change with perhaps some social distancing and health safety protocols in place. In fact, the lease flexibility part will be a big plus in this uncertain economic climate.

“Having experienced the WFH option, people are likely to want to spend more time working from their co-living home if they have good and reliable internet connection. In this regard, the co-living model will likely shift to incorporate workspaces in the common areas of the development or work desks within the units to cater for residents who desire to WFH, which will ultimately add to the appeal of co-living spaces,” he says.

He suggests that operators of co-living space offer greater flexibility in the contract to make it more accessible and affordable to those who may be impacted by the pandemic and economic downturn.

JLCL’s Lee says business has not been greatly affected by the pandemic. “In fact, our occupancy is much higher now than before the MCO. We will make sure that our tenants are tested and cleared before they move in. We put a lot of emphasis on [observing] the standard operating procedures [in using] the common facilities.”