Last year was a tough one for almost all property sectors. According to data from the National Property Information Centre (Napic), in 1H2020, Malaysia’s property market transaction volume and value decreased 27.9% and 31.5% respectively compared with the previous year. While most property consultants believe there should be some recovery this year, it will depend on the Covid-19 vaccine as well as the performance of the job market and economy.

This article first appeared in theedgemarkets.com. View source here.

Some consultants think there will be opportunities for investors in the auction market with foreclosures likely to increase, but others believe that owing to government intervention and the low interest rate environment, this might not be the case. On the other hand, this could be a golden opportunity for first-time homebuyers to purchase their dream home. However, as property is a long-term investment, the age-old advice of doing your homework and buying what you can afford continues to hold true.

The following are the consultants’ thoughts and comments for 2021.

CBRE | WTW managing director Foo Gee Jen

A lockdown brought the economy and property market to their knees in 1H2020. The resumption of activities and proactive fiscal stimulus measures by the government helped buoy the economy in 2H2020. Considering the economic and social costs, policymakers and the public have come to a consensus on a blanket economic shutdown in the future. This should restore some confidence and certainty, facilitate decision-making and effectuate transactions, although volatility will linger until a Covid-19 treatment is found.

Historic low interest rates, coupled with a string of homeownership incentives, will reduce the barriers to residential purchase, or better, accelerate the buying plans of prospective buyers, who may enjoy more bargains and a wider selection.

On the commercial front, lower borrowing costs, rental adjustments and readiness to negotiate are conducive for tenants and investors who are on expansionary mode. Inevitably, there will be owners who experience cash-flow issues. Hence, they may be encouraged to let go of their properties or opt for a sale and leaseback arrangement in exchange for liquidity. This will present opportunities for investors to pick up quality assets in prime locations with reliable income-generation capacity. Additionally, the infrastructure undertakings listed in Budget 2021 will boost the confidence of investors when they assess about investing in Malaysia.

This pandemic has undoubtedly attested to the value of technology-readiness. Technology has essentially negated the physical obstacles in our work and consumption needs. For businesses, technology has proved to be an effective tool to transition their operations amid the recurring disruptions, and a strategic platform to explore new avenues for business continuity or even survival.

This pandemic crisis also highlighted the importance of prudent planning based on a feasibility framework rather than sentimental optimism. For instance, residential properties that are in sync with demand in terms of location, pricing and product will have an edge.

Generally, domestic demand was characterised by higher stability but lower net worth, while the opposite was seen when it came to foreign demand. Therefore, a global-scale crisis like this poses a question to property players with regard to striking the right balance between domestic and foreign demand.

In Budget 2021, the government continued its commitment to deliver more affordable housing. Since the new supply is entering an already-soft and overhang market, planning, backed by thorough analysis and market study, is needed. Drawing from the lessons learnt from some underperforming affordable housing projects in the past, the approach for this segment has to be more methodical and curated to avoid aggravating oversupply.

In 2021, the low base effect from negative growth in the previous year dictates that gross domestic product (GDP) growth will take its course, although the real gains on the ground may not be as evident. For the property market, any corresponding improvement may only be observable from 2H2021 owing to information lag. From a long-term sectoral perspective, apart from logistics and warehousing, Covid-19 could also be a boost for some niche sectors, namely data centre and cold storage facilities.

CCO & Associates director Chan Wai Seen

If not for the moratorium and targeted moratorium, it would have been a disaster for the domestic property market in 2020. Low interest rates and the reintroduction of the Home Ownership Campaign (HOC) sustained the overall Malaysian residential property market performance last year.

Overall, stable performance was observed for the residential and industrial property markets in 2020 while hospitality was the worst affected sector, followed by the retail and office property sectors.

The recovery in the market depends very much on how the government kickstarts the economy and how Covid-19 is contained. Based on the projected 6.5% to 7.5% economic growth for 2021, we expect the property market to record improvements.

If borders reopen, we foresee pent-up demand in the hospitality sector. The reduced supply of hospitality properties, attributed to the closure of hotels/resorts/Airbnb properties during the Movement Control Order (MCO) period, augurs well for the existing hospitality properties.

We foresee a spike in property auctions when the targeted moratorium is withdrawn unless financial assistance continues to be provided to the affected groups. Recovery of business activities may take time while loan repayment obligations will be immediate if the moratorium is withdrawn completely.

With the price correction and various incentives offered, I think it is a good time for home seekers to buy properties for owner-occupation. With the increasing prospect of effective Covid-19 vaccines in 2021, investors who look for recurring rental income should focus on prime commercial and industrial properties, which can generate good and sustainable rental income.

Many prime properties may be available for sale under the current market conditions. We anticipate businesses to recover once the risk of Covid-19 is fully contained. There is good prospect the rental yield will increase when the economy recovers.

Covid-19 is a major “reset” for the country’s economy. The new normal has changed the Malaysian way of life and created both opportunities and hardship for people and companies. This outbreak has also exposed the lack of a social safety net (for individuals and companies) and the vulnerability of the country’s economy.

To expedite the recovery in the property market, the Covid-19 outbreak needs to be contained to instil confidence for consumers to spend and companies to expand to the pre-Covid-19 level. Reopening international borders is imperative for certain property sectors, namely hospitality, retail and, to a certain extent, the industrial property sector. This is also imperative to reactivate commercial activities at the Iskandar Malaysia region, which relies heavily on visitors from Singapore.

Henry Butcher Malaysia COO Tang Chee Meng

The first half of 2020 was very challenging for the property market as the MCO imposed from March to May brought a halt to all physical property sales activities. Although the residential market picked up after the MCO was eased in June, there was a drop in the volume and value of transactions last year.

The retail sector has been badly affected as shoppers stayed away and this resulted in a decline in the overall occupancy rate of malls. The office sector also recorded a decline in occupancy rate owing to reduced demand as a result of companies deferring expansion plans, adopting work from home (WFH) practices, retrenching staff or closing down. The industrial sector also saw a reduction in the volume and value of transactions owing to lower demand caused by a global economic slowdown.

We expect the property market to recover at the earliest in 2H2021, especially if a vaccine for Covid-19 becomes available. We expect, with the change of administration in the US, that there will be more certainty in US policies, which will be beneficial to world trade and relations between countries. This will help the global economic recovery and, ultimately, benefit the Malaysian economy and property market — provided that the country’s political quagmire does not worsen.

The sluggish property market has resulted in property developers offering discounts, rebates, freebies and easy payment schemes to boost sales. In the secondary market, owners have now become more realistic in their price expectations. This has created an attractive climate for investors and homebuyers, who never had such opportunities when the property market was hot a few years ago. Developers have also been refocusing their attention on building affordable homes priced below RM500,000, resulting in an increase in such offerings to investors and homebuyers.

What can be done to expedite the recovery in the property market? Developers have learnt that they need to innovate and not rely solely on the traditional ways of marketing their projects. They have adopted new digital technologies, switched to online marketing platforms and reduced over-reliance on traditional onsite marketing activities. The government has introduced measures under the Penjana and Prihatin economic recovery programmes as well as Budget 2021 to help the property market.

However, more needs to be done to expedite the recovery of the market, such as extending the stamp duty waiver to the secondary market, reducing compliance costs temporarily to lower house prices, and abolishing the Real Property Gains Tax (RPGT) for disposals after five years of ownership.

JLL Property Services (M) Sdn Bhd country head YY Lau

While the Ministry of International Trade and Industry is forecasting a slow U-shaped economic recovery, the real estate market is expected to experience an even more gradual recovery. The Malaysian economy is projected to contract in 2020 at 3.5% to 6%, and the road to recovery may only start in 2021, hopefully, with the help of Budget 2021.

The property market is still seeing overhang or oversupply in multiple sectors. About 31,000 residential units and 29,000 commercial units (including serviced apartments) have been recorded to be overhang thus far. Office buildings in general are also seeing a decline in occupancy. Although recovery will come, we should not expect it to be so soon.

Opportunities lie in understanding the evolving market. With companies allowing their workers to WFH or remotely, buyers’ criteria for choosing houses will be different — central locations may be less important, a larger unit size is preferred to allow for work space, and the provision of high-speed internet is essential.

As noted in JLL’s Budget 2021 highlight, a significant portion of the budget allocation can further benefit the industrial sector, which has already been observed to be the silver lining. This includes the RM1 billion allocation to encourage investment in high technology, high value-added and research and development activity in the aerospace and electrical and electronics sectors in Batu Kawan Industrial Park, Penang, and Kulim, Kedah, as well as non-fiscal initiatives such as the increment of sales value limit from 10% to 40% for activities at free trade zones and bonded warehouses.

Homebuyers and investors can also take advantage of measures announced by the government and Bank Negara Malaysia such as low interest rates, stamp duty exemption and the removal of the 70% loan limit for the third property. Throughout the MCO, there were a lot of offloadings, especially in the residential sector. Globally, investors can look into countries with good handling of the pandemic and safeguarding of their economy.

Lessons learnt during the pandemic include industry players having to moderate their appetite in taking risks, at least in the short term, as some are experiencing the consequences of earlier risk-taking decisions.

Meanwhile, the potential of resilient sectors, such as data centres, is being recognised further. JLL has received increasing interest, both locally and internationally, especially from Japan, for data centres, particularly during the Conditional MCO (CMCO).

In the short term, we expect the property market to recover following an economic recovery, as people are struggling to maintain their livelihood. Welfare and fiscal assistance in Budget 2021 can improve this situation. In the medium to long term, the property market will need to adapt to the new norms, be it in new supply development or in its operation.

KGV International Property Consultants executive director Samuel Tan

Covid-19 will continue to remain a threat to business and consumer confidence this year, unless an effective vaccine is available. If a vaccine is confirmed, the property market is likely to see a rebound in 2H2021. However, the market recovery will be uneven, with the landed residential segment expected to take the lead and properties in favoured areas priced between RM300,000 and RM700,000 to see better response.

Meanwhile, the current climate is good for homebuyers as it is a buyer’s market. Borrowing rates are at an all-time low, developers are more willing to sell at a lower profit margin for better cash flow, and there are many keen sellers in the market who are ready to negotiate a deal. The government has also introduced various incentives, such as the HOC and other stimulus packages, to encourage property purchase, especially for first-time homebuyers.

For investors, it is a good time to buy good-grade properties that can give high yields when the market recovers. For those who can afford the time, there will also be some good picks in the auction market.

One of the lessons learnt from this pandemic is sustainability. As property investment is a long-term venture, it is important not to be over-geared and to ensure that there is sufficient reserve to tide you over dry spells.

Another lesson is affordability — the art of not investing more than what one can afford no matter how attractive the future may be perceived to be. Any risks taken must be calculated and not accidental.

For property market recovery, all stakeholders, including the government and private sectors, must ensure supply matches demand, and the cost of development is brought to a reasonable level. There must also be more transparency in property pricings so that the banking system will not be misled.

Developers should ensure all residential developments are WiFi-enabled and conducive to working from home. The blurring of boundaries between office and home, office decentralisation and the downsizing of offices in urban centres will gradually evolve. Planners, developers, buyers and tenants would have to embrace these new changes.

Knight Frank Malaysia managing director Sarkunan Subramaniam

Last year, the retail and hospitality sectors were badly affected, followed by residential, where interest in the primary market prevailed, and the office sector, whose market was sustained to a certain extent by the growth of the technology, pharmaceutical and e-commerce sectors. The logistics sector and certain industrial segments fared very well owing to the e-commerce, pharmaceutical and technology sectors. For instance, the semiconductor market saw demand as its component is needed in many tech gadgets.

The 2021 property market is very much dependent on the state of the economy. The current slew of job losses, salary cuts and the lifting of the loan moratorium will certainly impact the market, especially the residential sector. The desire to conserve cash will limit transactions.

The office market, facing an oversupply situation, will be subject to downward rental pressure. However, the growth of the technology, pharmaceutical and e-commerce sectors may bring some relief to this market.

If there is a vaccine for Covid-19, the retail and tourism markets will see a recovery as people will want to satisfy their pent-up demand for shopping and travelling. Otherwise, this sector will remain in the doldrums. The industrial and logistics sectors will continue to see steady growth. However, growth may taper as demand is fulfilled.

As for homebuyers with cash, the opportunity lies in the secondary market, especially distressed assets, and in the primary market, by taking advantage of developers’ incentives or rebates. The same applies to investment assets, which may have repositioning opportunities or locational advantage. Sale and leaseback opportunities, especially in the industrial sector, are a good consideration for investors with cash backing.

The most important lesson learnt in this pandemic is to be technologically prepared and advanced. Secondly, to ensure that one is not over-geared and has a reasonable buffer if the market goes south. Having such cash reserves will also enable an investor to jump into a rising sector during a pandemic.

The most important thing to expedite a recovery is a responsive government that extends relief and monetary incentives to the economy. For the current property market, exemption in taxes such as RPGT and stamp duty and extending it across the board will certainly bring some recovery to the market. The loan moratorium, the easing of interest rates and other reliefs extended by the government will certainly help cushion the blow due to Covid-19, and sustain and lead the market to recovery.

Landserve Sdn Bhd managing director Chen King Hoaw

After years of decline and consolidation, the domestic property market saw a recovery in 2019. However, the Covid-19 pandemic, which struck the country in February 2020, drove the property market back on its downward trend. Fortunately, the government was quick in bringing back the HOC, which took effect from June 1, 2020, and ends on May 31, 2021. That helped boost the property market.

Generally, the property market’s performance in 2021 depends heavily on the country’s economy. Political uncertainty continues to plague the country while the government is fighting to contain Covid-19. If this situation is prolonged, more business closures and job cuts can be expected, which will weaken the economy. Under such circumstances, recovery in the property market is unlikely this year.

However, if the pandemic is well contained or no longer a threat and our nation’s economy improves in 2021, underpinned by political stability, rising oil and commodity prices, public spending to pump-prime the economy, job opportunities and so on, then some form of recovery in the property market can be expected in 2H2021 or 2022.

Homebuyers can take advantage of the discount on sale price and incentives under the HOC 2020, which mean huge savings. Interest rates for housing loans are also at a record low.

In addition, investors can look out for properties that are put up for auction as such properties, which failed to attract successful bidders after several rounds of auctions, will see their reserve prices reduced substantially. However, one should not be motivated by price alone. Before making any decision to invest, always consult your estate agent for professional advice.

The pandemic has changed the way we live and work, bringing about a new set of challenges, risks and opportunities. It reminds us that real estate is never a short-term investment. Do not speculate as it is risky. Market research is essential.

To expedite the recovery in the property market, the government and developers must take immediate steps to curb over-building of properties that are not in demand. The HOC 2020 is laudable in boosting demand. Perhaps, the government can consider extending it to cover selected properties in the secondary market.

LaurelCap Sdn Bhd executive director Stanley Toh

The property market has been generally subdued because of the Covid-19 pandemic, which resulted in poor market sentiment. Nevertheless, the government’s initiative to extend the HOC has given a boost to the domestic market. Developers were able to clear stock and purchasers had the opportunity to own their dream homes at a discount, together with other benefits such as full stamp duty exemption of up to RM1 million, partial stamp duty exemption of up to RM2.5 million, stamp duty exemption on instrument of securing a loan of up to RM2.5 million and 10% house discount for properties registered under the scheme.

In addition, Bank Negara’s decision to cut the overnight policy rate (OPR), leading to a reduction in interest rates, also helped the property market.

In the secondary market, we saw a few fire sales during the MCO period (between April and June 2020) in some prominent areas such as Desa ParkCity, Damansara Heights and Taman Tun Dr Ismail. Nevertheless, in 3Q2020 and 4Q2020, asking prices of these areas reverted back to pre-Covid-19 levels.

We observed that during this pandemic, many people invested in the stock market, hence the surge in retail investors. These people will eventually cash out when the Covid-19 vaccine starts to be rolled out and is effective. With cash, they are most likely to invest back in the property market. The property market normally tailgates the country’s economy, and the effects will only be visible six to nine months down the road. With the vaccine due to hit the market in 1Q2021 or 2Q2021, we envisage that the property market will most likely gain momentum in 1Q2022.

For investors, the industrial property market seems to have done better than the retail, office and leisure markets. The warehousing segment was in demand mainly owing to online transactions during the MCO period. For homebuyers, they should take advantage of the HOC programme and the low interest rate environment to maximise their opportunities.

From the property sector’s perspective, the pandemic has taught us about diversification, adaptability and versatility. The traditional way of buying and selling properties has to change. Virtual viewing of properties, online meeting and applications and so on are the new norms.

Developers will also have to bear in mind when designing a home that homebuyers will want a house with more space to conduct their online meetings as well as for their children’s online education and homework.

One thing that could help expedite the recovery of the property market is to relax the rules for foreigners to own properties in Malaysia once the vaccine is out and stable and the Covid-19 threat is diminished. The borders will be opened by then and the MM2H (Malaysia My Second Home) programme should resume.

Also, financial institutions need to be proactive in approving loans, especially for first-time homebuyers, as we see that many people are keen to buy a home but are denied the opportunity because of loan rejections.

Metro Homes Realty Bhd executive director See Kok Loong

The year 2020 has been a challenging one for the property market owing to the pandemic. A high unemployment rate, retrenchments and the closing of businesses are expected to continue until early 2021. Buyer sentiment is low except in mature areas such as Bangsar, Damansara and Desa ParkCity, where purchasers snap up deals when prices drop 10%, and sellers are more willing to take up the offer due to the uncertainty. The only good news for the property market is the record-low interest rate and the six-month loan moratorium.

My opinion of the market in 2021 is that it will continue its downward trend as the overall economy is not doing well and there is a lack of a stimulus package by the government to push recovery. I expect low transaction volume for 2021 as people will not commit to big-ticket items during a recession. For first-time homebuyers, the memorandum of transfer (MOT) stamp duty waiver is until 2025 based on Budget 2021, so they don’t need to rush to buy now.

A lot of good buys will appear in 2H2021, as we foresee a lot more foreclosures by banks, mainly based on the number of applicants asking for further financial aid after the moratorium, which is around 500,000 cases. Coupled with the high household debt of around 86% of GDP, the foreclosures will surface in 2H2021 if the overall economy does not recover by then.

Homebuyers will have the opportunity to choose their choice units from mid-2021 as more units will be available for sale then. For investors, certain prime shopoffices will be up for sale at a reasonable price in 2021. For example, during the 1997 recession, shopoffices in Jalan SS 21/39, Damansara Utama, were sold at RM400,000 compared with the average price of RM1 million in 1995 and 1996.

For businesses, lessons learnt from the pandemic are always have low gearing and be asset-light. A government policy that is business-friendly and open to foreign investment is needed to enable the recovery of the property market. For example, for local businesses, cut the red tape of doing business and encourage Malaysians to innovate and compete since we are part of the Regional Comprehensive Economic Partnership (RCEP), and encourage other countries like China, Japan and South Korea to set up bases here to boost the market.

Nawawi Tie Leung Sdn Bhd managing director Eddy Wong

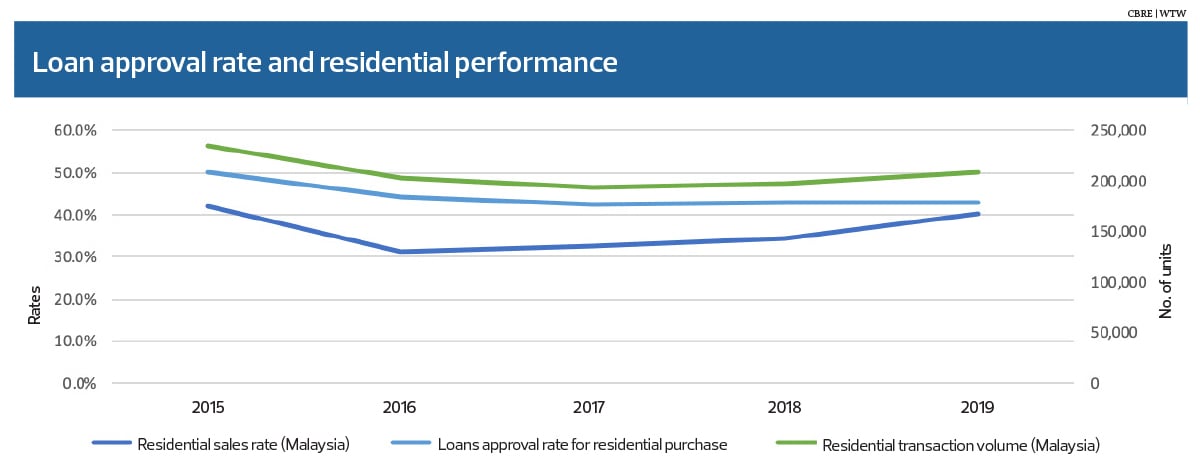

The residential property market saw a sharp decline in 1H2020, largely owing to the lockdown as a result of Covid-19. The ratio of loan approvals to loan applications for the purchase of residential property declined from 44.1% in January 2020 to 24.6% in June 2020.

The residential property overhang, defined as unsold completed properties that have been in the market for more than nine months after launch, increased 3.3% to 31,661 units compared with 2H2019. The property overhang is most pronounced in Johor (6,166 units), followed by Selangor (4,865 units) and Perak (4,644 units).

If “unsold under construction” properties and “unsold not constructed” properties are included in the overhang numbers, there will be a grand total of 120,433 units of unsold properties, indicating that the oversupply situation is quite serious.

In response to Covid-19, the government announced stamp duty exemption for the purchase of properties between RM300,000 and RM2.5 million under the HOC and RPGT exemption for the disposal of residential properties. In addition, the 70% financing limit applicable for the third housing loan onwards for property valued at RM600,000 and above was lifted. Despite all the initiatives, the number of transactions for 2020 is expected to remain subdued.

The market is expected to remain challenging in 2021 in view of the weak sentiment amid the economic shocks resulting from Covid-19. While GDP growth for 2021 is projected to recover to between 6.5% and 7.5%, concerns about job security and the overall affordability and availability of housing loans will continue to affect demand.

The residential property market may take a while longer before it improves and any recovery is likely to be fragile. This is an excellent opportunity for those looking to buy properties, especially if buying for own stay, as it is a buyer’s market and there are many incentives and freebies being offered by developers in addition to the stamp duty waiver under the HOC. Investors should remember to do their homework and seize this once-in-a-lifetime opportunity to pick up a choice property.

It is good to adopt a longer-term view of the market, and if you do not already own a property, this is the perfect time to start looking for one. A down market is the best time to buy properties as the market will eventually recover. Look for properties with good accessibility to amenities, that are well connected and located in a great neighbourhood. Prices are very attractive in today’s price-sensitive market.

This pandemic has prompted us to review our current ideas about the design of residential homes and how space planning needs to accommodate WFH (and study from home) in the new normal.

The recovery of the property market is dependent on not just the development of a vaccine but also the availability of the vaccine to the general population. Hopefully, in the interim period, we are all able to behave responsibly so that there will not be another lockdown and economic activities can fully resume as soon as possible. It is only when confidence returns that the property market is able to recover from this downturn.

PA International Property Consultants (KL) managing director Jerome Hong

Overall, the property market is in a consolidated period. In the housing segment, there were fewer launches. Developers of selected schemes, however, have reported strong bookings following the reintroduction of the HOC in June although the conversion rate of bookings into sales may be lower owing to stringent financing guidelines.

The prolonged pandemic and the economic slowdown owing to the various phases of MCO amid a resurgence in cases are likely to continue to affect the investment climate, businesses and market sentiment, particularly the tourism and retail sectors.

Residential property prices are expected to remain stagnant owing to lower interest rates, with buyers participating in projects under the HOC. Amid heightened competition and a challenging market environment, developers are expected to review their pricing and marketing strategies to boost sales. Developers with large land banks will continue to focus on terraced homes and the affordable segment to drive sales. We expect to see a correction in pricing in the high-end segment.

Both investors and homebuyers should look at established locations and popular suburbs that provide affordable to mid-range pricing and mixed-use developments with connectivity to ongoing transport rail lines such as LRT Line 3 and MRT Line 2, which will enable them to enjoy both good returns and capital appreciation over time.

Technology and internet facilities (accessibility/connectivity) are playing crucial roles during the prolonged lockdowns. The pandemic has accelerated technology trends such as digital payments, Zoom meetings, online shopping, distance learning and developers’ virtual launches.

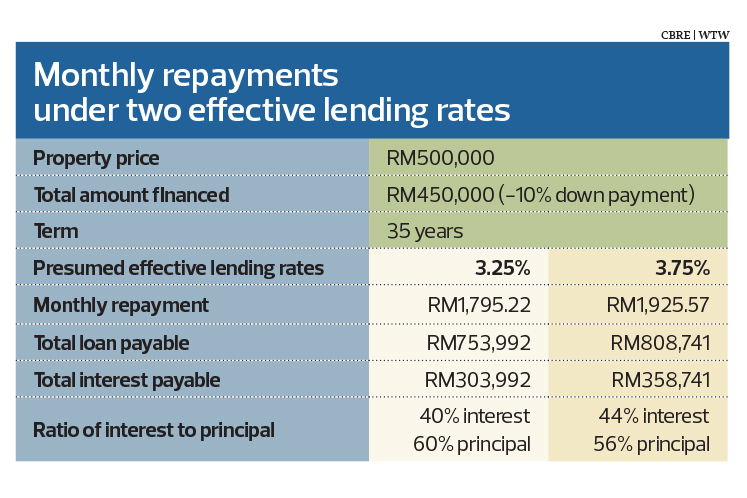

To stimulate the property market, we hope the government can consider raising the maximum loan tenure to 40 years to reduce monthly instalment payments; increasing the loan margin to 10:90 or 100% loan; and lowering the initial borrowing rate for a fixed term and thereafter to revert to the prevailing market interest rate. For instance, fix the interest rate at between 2.8% and 3% in the first five years and thereafter to the market interest rate.

Furthermore, increase the margin of withdrawal from EPF Account 2; extend the waiver of RPGT across all property sectors; and extend the HOC incentives to the secondary market — a waiver on stamp duty for properties up to RM1 million on the instrument of transfer for the purchase of residential properties and for financing agreements in order to boost the secondary market.

PPC International Sdn Bhd managing director Datuk Siders Sittampalam

Between March and June 2020, the market was at a standstill. Transactions were very few in numbers. In terms of volume of transactions, there were very few except for large industrial properties. Subsequently, the market picked up but overall, the number of transactions has dropped this year. The total transaction volume and value for 1H2020 decreased by 27.9% and 31.5% respectively (from 160,165 units in 1H2019 to 115,476 units and from RM68.53 billion to RM46.94 billion).

I do not envisage the property market bouncing back to pre-Covid-19 levels in 1H2021. However, market recovery is expected to be seen in 2H2021 with more economic activities and government infrastructure expenditure.

With regard to the moratorium, financial institutions have to consciously undertake the restructuring of problematic loans where borrowers are having difficulties in servicing them or alternatively require interest-only payment instead of the principal for the year 2021. This is to avoid loans going bad in a large way and reduce the high volume of auction properties placed in the market, dragging the market down with excess supply. Also, compliance cost has to be looked into to reduce the cost of developments. Concerted efforts must be made by the federal and state governments.

Homebuyers may see more affordable homes being built, and this would correct the mismatch between demand and supply to a large extent, although this may not be the solution to the current overhang in the market. The pricing of new properties in the market will reflect market fundamentals, with rebates, freebies and interest-bearing schemes diminishing in new launches.

During this period, there have been good properties placed on the market such as landed properties in good residential areas. It will perhaps take another year or two for the property market to see an upswing, for example, the residential schemes in Greater KL. Also, every sector of the economy has been affected.

What are the lessons learnt so far? Perhaps more market studies have to be done, and also policies implemented in order for planners to ensure that for every development approved, there is sufficient justification for it. Moving forward, we hope the market will be more rational — that there is gradual and organic growth rather than a sudden appreciation in the market, and is sustainable for a long period.

Moreover, the definition of affordable homes has to be redefined. We fail to ask, affordable to whom? Affordable should be measured against income levels and the repayment capacity of buyers. High-end or highly priced properties appeared to be more sensitive to the pandemic and the weakening of the economy. Landed residential properties, especially terraced houses, appeared to be resilient to economic crises and the pandemic.

Rahim & Co International Sdn Bhd director of research Sulaiman Saheh

At the national level, in all major sectors, both volume and value of transactions declined in 1H2020. Office and retail occupancy rates also dropped, as shops and offices were closed, as were the tourism and hotel sectors, which were the first to be hit by the pandemic.

With the reopening of the economy during the Recovery MCO in 2H2020, market sentiment improved, with the Malaysian Institute of Economic Research’s (MIER) Consumer Sentiment Index seeing a rebound in 2Q2020 but it has yet to reach the optimism threshold.

There was also a boost in business confidence, with improved sales and an increase in export orders, which kept the labour market’s concerns about unemployment and income security at bay temporarily. Although movement in the property sector is stickier, the steady improvement in sentiment and the reportedly better-than-expected numbers in loan servicing post-moratorium could revive the market, which currently favours buyers through the slew of benefits from the reintroduction of the HOC, relaxed LTV (loan-to-value) ratio, RPGT exemption and low interest rate environment.

However, there are concerns about the sustainability of sentiment, which was affected with the second and third waves of the pandemic, leading to the reimposition of the stricter CMCO in a number of areas, including the Klang Valley.

Although several incentives were introduced by the government to boost the economy, the property sector does not just rely on domestic drivers but also foreigners’ participation and international markets.

While the allocation for Budget 2021 was huge, provisions that directly boost the property sector were rather targeted. This is understandably so, as the focus was to strengthen the roots of the economy rather than treating the superficial symptoms, for a more sustainable and solid growth of the market at large by focusing on expenditures with high multiplier effects.

We expect a gradual recovery in the property market as the pace of recovery in the country and world gains momentum. Currently, the market’s focus is to increase homeownership, especially for first-time homebuyers and the more vulnerable groups. With stamp duty and RPGT exemptions and a low interest rate environment, interest in the residential segment will increase but the question remains whether it will outweigh concerns about income levels, house prices, loan eligibility and affordability.

There are always opportunities for genuine homebuyers in the market, especially in the current supportive environment. The benefits of owning one’s dream home — by either purchasing from the primary market for a new unit or from the secondary market in a mature estate — could be worth it, especially in a market with potentially good bargains.

Investors are also gearing up for the expected bargain hunting, especially in established locations and newer developments near to transport hubs. While purchasing for one’s own use is fine for almost any type of property that meets the needs of the individual, investment properties are more susceptible to market dynamics, as competition is keen and substitutes or alternatives may be abundant.

Although the Covid-19 factor is a black swan event, issues such as high house prices, property overhang and oversupply situations can be better avoided at the earlier stages of a project’s decision-making.

A proper and independently conducted feasibility study should be made before embarking on any project, and this could apply to the local authorities or project financier, who holds significant influence on the project’s progress. Approvals by the authorities should be conditional on timely implementation, with strict controls over extensions.

Consequently, we hope that with more liquidity, higher disposable income and job and income assurances, the property market could get a boost post-pandemic. While many can come up with their wish list for more stimulus injections, the government has to decide on the best-balanced allocation according to expenditure priorities, which is a mammoth task by any measure.

Raine & Horne International Zaki + Partners Sdn Bhd senior partner Michael Geh

The number of residential property transactions in Malaysia for 1H2020 declined about 30%. The number of transactions dropped from 168,482 units worth RM72.88 billion in 2H2019 to 115,476 units worth RM46.94 billion in 1H2020 — the lowest number recorded in a half-year between 2014 and 2020.

The number of transactions in the primary market was at an all-time low in 1H2020, with 14,789 transactions valued at RM5.59 billion compared with 20,300 transactions valued at RM8.07 billion in 2H2019.

The secondary market also saw a drop, from 89,064 transactions at RM29.68 billion in 2H2019 to 60,529 transactions at RM20.03 billion in 1H2020. The secondary market made up the bulk — about 80% — of the total transactions in 1H2020.

Meanwhile, the number of transactions in the commercial sector for 1H2020 dropped to only 8,118 units valued at RM8.51 billion, almost 35% of the transactions in 2H2019.

Only 1,980 transactions valued at RM5.41 billion were recorded for industrial properties in 1H2020, a decline of 40% compared with 3,123 transactions valued at RM7.83 billion in 2H2019.

The 2021 market is expected to fare better owing to better control of the Covid-19 pandemic and stricter social distancing practices, which will allow businesses to be conducted normally, boosting property transactions above 2020 levels.

Residential properties in hotspots, along with transport hubs, will maintain their value. We also do not foresee the widespread auction of homes.

Opportunities for investors and homebuyers in the current climate will result from the change of preference from high- to low-density living, thus, suburban and semi-rural settings are trendy. Lessons learnt from the pandemic include the importance of having a long-term economic recovery plan to ensure sustainable economic growth and increase investor confidence.

We believe the government had given exceptionally strong support to the property market in 1Q2020 and Budget 2021, which will promote the rakyat’s well-being, business continuity and economic resilience.

Savills Malaysia Sdn Bhd managing director Datuk Paul Khong

Local political and global geopolitical uncertainties made 2020 a tough year. However, the loan moratorium and the Penjana and Prihatin stimulus packages were helpful in shoring up the market in Malaysia until the end of 2020 and partially into 2021.

Though we were impacted by these events, the markets were given a fair chance to recover. The markets closed relatively flat at end-2020 with Budget 2021 having little impact on them and with no major movements.

The property market will remain challenging in 2021, especially with the easing of the government’s stimulus programmes. We expect the property market to struggle through this period, with more foreclosure auctions surfacing owing to the current economic headwinds and the dwindling job market.

The residential market is anticipated to remain subdued. While the reintroduction of the HOC 2020 has encouraged home purchases, the risk of financial instability has made buyers re-evaluate their purchase decisions.

In the commercial sector, retail and hospitality were among the most impacted sectors owing to the pandemic. As the economy gradually reopened in 3Q2020 with cases under control, the better malls saw an increase of 80% to 90% in footfall. The same trend was observed in the hospitality sector, as people had started to travel domestically since then. However, the rising number of Covid-19 cases in 4Q2020 led to CMCO being reimposed in Greater KL and various locations, and as a result, these sectors’ recovery was again affected for the rest of the year.

Meanwhile, investors and homebuyers will see some bargains coming as the markets adjust back with a reality check post-moratorium. It is a good time to buy, especially when the market is on a downward trend and asking prices for residential properties are well discounted.

Developers will continue to offer better bargains in the primary market to attract sales. With the easy entry owing to low deposit payments and free stamp duties for transfers and loans and freebies, these offerings are getting interesting and worth considering. Now is the time to “buy low, sell high”. As such, it is important for purchasers to have cash flow to hold investments in the short to medium term to reap the actual benefits.

The pandemic has also accelerated growth in the technology and healthcare sectors, which led to the demand for industrial, logistics and data centres. Logistics and data centres have boomed owing to changes in online shopping patterns and the shift in the shopping paradigm, thus increasing the need for cloud and physical product storage spaces.

The property market has remained resilient throughout the pandemic, being a stable investment. Real estate is a long-term investment and value will not fall off a cliff in most circumstances, but is subject to further yield compression in the short term. The road to recovery moving into 2021 is still an uphill journey during this uncertain period. Ultimately, we hope the vaccine will soon be available for all sectors to get back on track in the new normal.

VPC Alliance (KL) Sdn Bhd managing director James Wong

The office, retail and hotel/leisure sub-sectors were the most affected in 2020. The difficult operating environment owing to the pandemic and resulting business closures affected the occupancy rates and rents of these sectors.

The MCO and CMCO also negatively impacted the property market. The loss of consumer confidence, salary cuts and unemployment led to a cautious market sentiment, which caused buyers to delay their decision on purchasing a property despite the reintroduction of the HOC 2020 and attractive home loan rates.

Apart from that, the soft property market in 2020 was also affected by political instability and external factors such as the US-China trade war, disruption of the global supply chain and negative growth in major world economies. Additionally, oversupply is expected to build up in 2020 and beyond.

With the recovery of the global and Malaysian economy, Bank Negara has projected for a GDP growth of 6.5% to 7.5% for 2021, and this should lead to a gradual recovery of the property market this year.

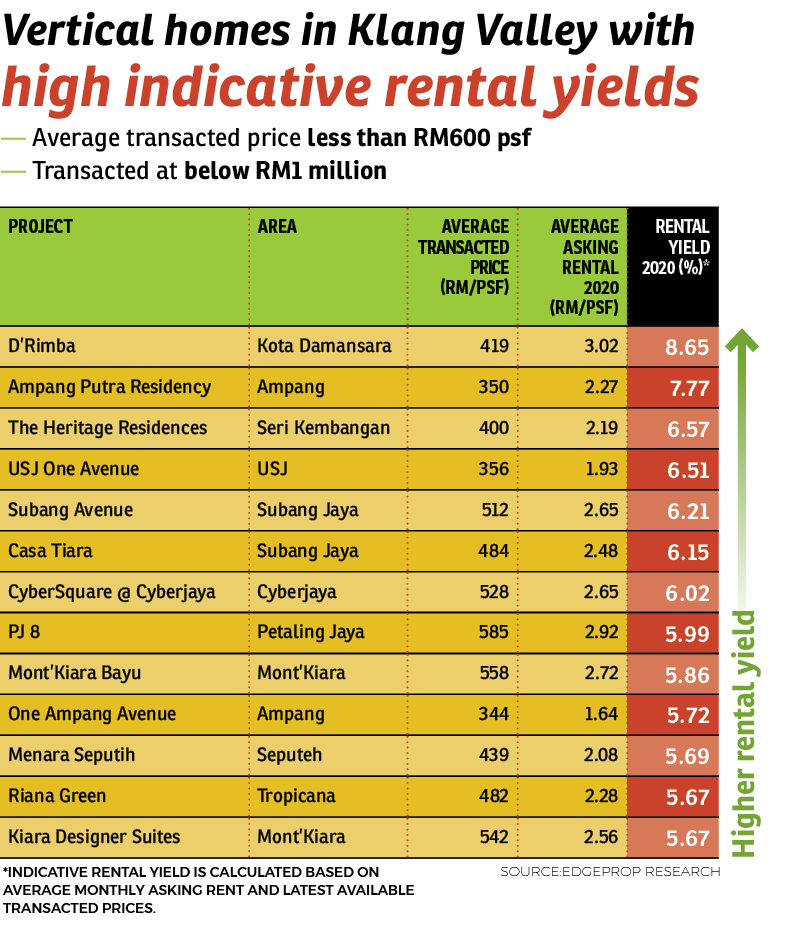

Meanwhile, more than 53.2% of property overhang is in the condominium/apartment, serviced apartment and SoHo categories, thus their prices are expected to further decrease in 2021, providing buying opportunities.

With the stamp duty exemption announced in Budget 2021, there will be buying opportunities for properties priced RM500,000 and below, especially for first-time homebuyers. There will also be more auction properties for discerning buyers in the coming months.

The lessons learnt from the pandemic include the new norms of WFH and social distancing practices. Technology will play an important role, including in marketing techniques and online purchases. Developers may also have to redesign the layout of houses to accommodate WFH features.

With the availability of the Covid-19 vaccine and the recovery of the global and Malaysian economy, business and consumer confidence will return to the property market and it is expected to recover by end-2021.

Zerin Properties managing director and CEO Previndran Singhe

The residential market saw a reduction in overhang volume with 29,698 units (RM18.91 billion) in 1Q2020, compared with 32,936 units (RM19.96 billion) in 1Q2019. Overall, Johor retained the highest number and value of overhang in the country, in which high-rise residential properties formed the bulk of the overhang. To increase homeownership and reduce the inventory of unsold houses, the HOC 2020 was reintroduced and RPGT exemption was granted.

As for the retail market, it saw a negative growth of 11.4% year on year in retail sales in 1Q2020. Many construction plans and openings of malls were delayed owing to the Covid-19 pandemic and implementation of MCO. Retailers sought rental assistance from landlords, either in the form of rental relief or deferment. This was, however, expected to be a trade-off between extension of leases and rebased rents.

Nonetheless, the retail sector gradually recovered in 3Q2020 owing to pent-up demand, which saw a 149% surge in online sales during the first five months of 2020. Malaysian retailers have started to prioritise digital platforms to stay relevant in the new normal.

Landlords and retailers are also looking at omnichannel retailing to integrate both the offline and online experience for shoppers. Additionally, the pandemic has provided an opportunity to experiment with new business models such as dark kitchens, platform-based communities and subscription models.

Meanwhile, we expect to see more moderate purchasing by investors, but investment appetite will remain healthy and will improve in 2021. We also anticipate 2H2021 to be a measure or benchmark of the tipping point in the market. Flexible office spaces, sustainable developments, assets with stable income and those offering better capital value growth will be the main focus for investors and homebuyers.

Consequently, a clear communication strategy by the Real Estate and Housing Developers’ Association (Rehda) Malaysia and the powers that be, on real estate as a secure investment class and a growth opportunity should be crafted and implemented to boost the property market. This will ultimately push Malaysia to be a regional emerging technology hub, wellness destination and distribution hub, while pursuing sustainability and liveability in this wonderful country of ours.